florida estate tax exemption

Up to 25000 in value is exempted for the first 50000 in assessed value of your home. Property Tax Exemption for Historic Properties.

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Property Tax Exemptions Available in Florida for People with Disabilities.

. The amount may include both the gross estate as. Florida law allows up to 50000 to be deducted from the assessed value of a primary permanent residence. At Marina Title we have a team of legal experts to guide you through the process and help you to get a.

Senior Citizen ExemptionsAs much as 50000 for people who are 65 years old or older and live in Florida with an income below 20000. The Florida state legislature cannot enact a Florida estate tax or inheritance tax that conflicts with the state constitution Florida voters would have to amend the constitution. Eligibility for property tax exemptions depends on certain requirements.

For example if a. A yes supports authorizing the Florida State Legislature to provide an additional homestead property tax exemption on 50000 of assessed value on property owned by certain public. Sales and Use Tax.

This local program is authorized by Section 1961997 Florida Statutes and allows counties and municipalities to adopt ordinances. Information is available from the property appraisers office in the county where. There is no specific exemption for documents that transfer Florida real property for estate planning purposes.

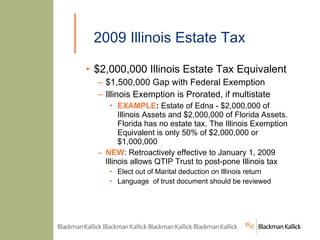

Sales Tax Exemption Certificates for Governmental Entities. Owns real estate with a just value. Taxable gifts are deducted from lifetime estate tax exemption.

FL Residents Home Owners Age 65 may qualify for an additional homestead exemption of up to 50000. Who has to file a federal estate tax return. The homestead exemption and.

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. In 2022 an estate generally must file a tax return if it is worth 12060000 or more. Additionally the link will provide the necessary forms to get the tax exemption process started.

See Rule 12B-4014 Florida Administrative Code for additional documents. The first 25000 of value is entirely exempt. Work with Marina Title to Obtain a Homestead Exemption in Florida.

This is the amount of money you can legally transfer. Household income does not exceed the income limitation. The above exemption applies to all property taxes including those related to your.

Florida law grants governmental entities including states counties municipalities and political subdivisions eg school. As long as your Florida estate tax payment exceeds the amount of your other states tax you wont be penalized. In 2019 the Federal Unified Gift and Estate Tax Exemption will increase from 1118 million to 114 million per person.

Unified Estate Tax and Gift Tax Exemption. Taxpayers Exemptions For additional Florida Real Estate information or to. Total and Permanent Disability.

Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005. If you have disabilities you may qualify for a 500 property tax deduction. Regardless of how much you own in the state you should.

Estate And Inheritance Taxes Urban Institute

Death And Taxes Nebraska S Inheritance Tax

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Considering A Move To Florida What You Need To Know About Changing Domicile Pnc Insights

Florida Estate Planning Complete Overview Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Attorney For Federal Estate Taxes Karp Law Firm

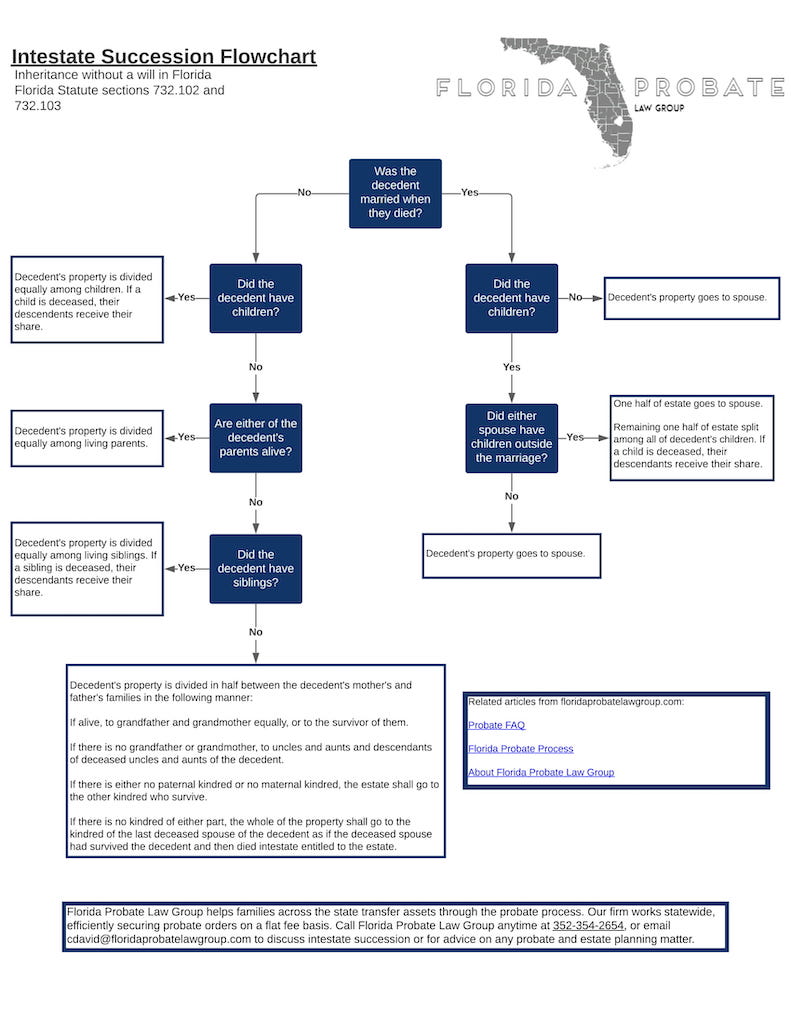

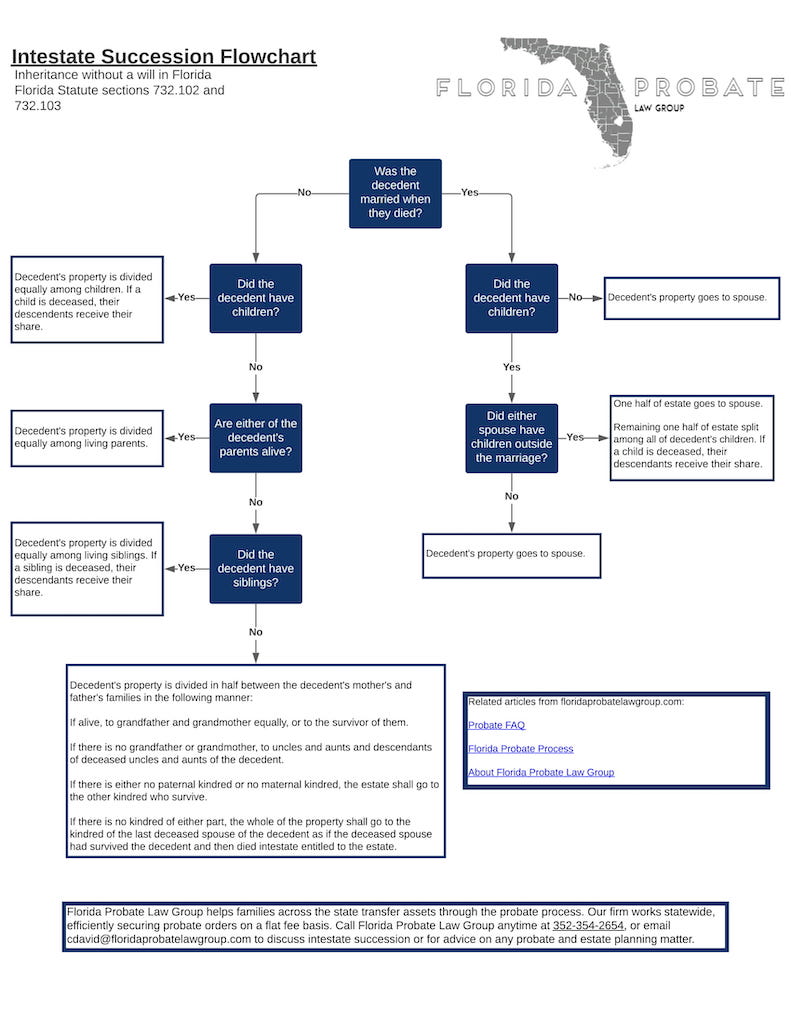

The Complete Guide To Florida Probate 2022 Florida Probate Blog January 2 2022

5 Tax Deductions For Florida Homeowners Michael Saunders Company

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

Moved South But Still Taxed Up North

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Federal Estate Tax Portability The Pollock Firm Llc

:max_bytes(150000):strip_icc()/Florida-47fa1160b4c84aec92f9de766d9163ff.jpg)

An Overview Of Taxes And Tax Rates In Florida